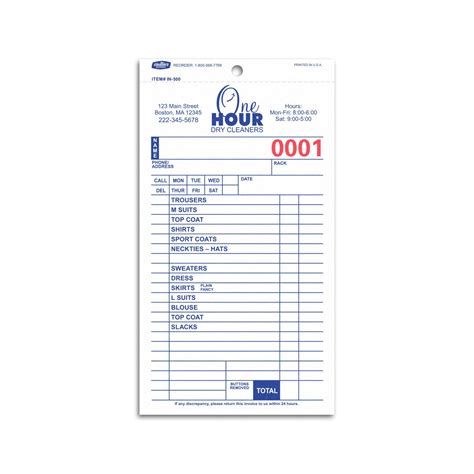

Custom receipt books are an essential tool for businesses and organizations to maintain accurate and detailed records of financial transactions. These books provide a comprehensive and organized way to document sales, payments, and other financial activities, helping to ensure transparency, accountability, and compliance with regulatory requirements. In this article, we will delve into the world of custom receipt books, exploring their importance, benefits, and features, as well as providing guidance on how to create and use them effectively.

Key Points

- Custom receipt books provide a secure and organized way to document financial transactions

- They help to prevent errors, discrepancies, and potential fraud

- Customizable receipt books can be tailored to meet specific business needs and requirements

- They are essential for maintaining accurate financial records and ensuring compliance with regulatory requirements

- Custom receipt books can be used in a variety of settings, including retail, hospitality, and healthcare

Importance of Custom Receipt Books

Custom receipt books play a vital role in maintaining the financial integrity of a business or organization. By providing a secure and organized way to document financial transactions, these books help to prevent errors, discrepancies, and potential fraud. They also provide a clear and transparent record of all financial activities, making it easier to track income, expenses, and profits. Additionally, custom receipt books can be tailored to meet specific business needs and requirements, ensuring that they are aligned with the organization’s financial goals and objectives.

Benefits of Custom Receipt Books

The benefits of custom receipt books are numerous and far-reaching. They provide a professional and organized way to document financial transactions, helping to build trust and confidence with customers, clients, and stakeholders. Custom receipt books also help to reduce errors and discrepancies, minimizing the risk of financial losses and potential litigation. Furthermore, they provide a clear and transparent record of all financial activities, making it easier to track income, expenses, and profits, and enabling businesses to make informed financial decisions.

| Feature | Benefit |

|---|---|

| Customizable layout | Can be tailored to meet specific business needs and requirements |

| Secure and organized | Helps to prevent errors, discrepancies, and potential fraud |

| Transparent record-keeping | Provides a clear and transparent record of all financial activities |

| Professional appearance | Helps to build trust and confidence with customers, clients, and stakeholders |

Creating and Using Custom Receipt Books

Creating and using custom receipt books is a straightforward process. The first step is to determine the specific needs and requirements of the business or organization, including the type of financial transactions that will be documented, the frequency of use, and the level of security required. Next, the layout and design of the receipt book should be customized to meet these needs, including the inclusion of relevant fields, such as date, time, amount, and payment method. Finally, the receipt book should be used consistently and accurately, with all financial transactions documented in a clear and transparent manner.

Best Practices for Using Custom Receipt Books

There are several best practices to keep in mind when using custom receipt books. First, it is essential to use the receipt book consistently and accurately, documenting all financial transactions in a clear and transparent manner. Second, the receipt book should be stored in a secure location, such as a locked cabinet or safe, to prevent unauthorized access or tampering. Third, the receipt book should be regularly reviewed and audited to ensure accuracy and compliance with regulatory requirements. Finally, the receipt book should be updated regularly to reflect changes in business needs and requirements.

What is the purpose of a custom receipt book?

+The purpose of a custom receipt book is to provide a secure and organized way to document financial transactions, helping to prevent errors, discrepancies, and potential fraud, and providing a clear and transparent record of all financial activities.

How do I create a custom receipt book?

+To create a custom receipt book, determine the specific needs and requirements of the business or organization, customize the layout and design of the receipt book to meet these needs, and use the receipt book consistently and accurately.

What are the benefits of using a custom receipt book?

+The benefits of using a custom receipt book include providing a professional and organized way to document financial transactions, helping to build trust and confidence with customers, clients, and stakeholders, and reducing errors and discrepancies.

In conclusion, custom receipt books are an essential tool for businesses and organizations to maintain accurate and detailed financial records. By providing a secure and organized way to document financial transactions, these books help to prevent errors, discrepancies, and potential fraud, and provide a clear and transparent record of all financial activities. By following best practices and using custom receipt books consistently and accurately, businesses can ensure compliance with regulatory requirements, build trust and confidence with customers, clients, and stakeholders, and make informed financial decisions.